Seamless Integration of Legal Services Between Your Business Needs and Your Personal Needs

Seamlessly Integrating Legal Solutions for Business and Personal Success.

Mencius Mediation™ using The Mencius Path™ Philosophy

The Tax Counsel™ also offers mediation services under its division called Mencius MediationTM

Tax-Optimized Bankruptcy Solutions

At The Tax Counsel™, our unique bankruptcy practice is intricately designed to navigate the complex interplay between bankruptcy law and tax controversy. Unlike many bankruptcy attorneys who may not engage with tax disputes, our firm is distinctively positioned to handle both.

Resolve Your Tax Debt

If you or your business owes back taxes, we can help you settle your debt and save your business. We rehabilitate people’s lives and businesses one tax case at a time.

Outside Tax Legal Counsel for Law Firms and Businesses

The Tax Counsel™ provides a specialized service designed to support law firms and small to medium-sized businesses through their Outside Tax Legal Counsel Program.

TheHOAAttorney™ - HOA Dispute Resolution and HOA Litigation

Building on her tenacious and strategic tax dispute and tax litigation experience, Mrs. Dawson-Man expanded her practice to assist homeowners facing challenges with Homeowners’ Associations (HOAs). Motivated by her personal experiences with unethical HOA practices, she has dedicated herself to advocating for homeowners’ rights.

Is Your Spouse Innocent?

Are You FBAR Serious?

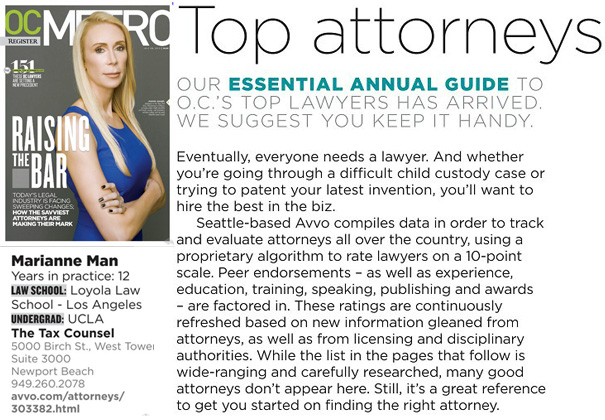

Best of Orange County

In OC Metro Magazine for 2013

Best of Orange County

In OC Metro Magazine for 2014

Best of Orange County

Tax-Optimized Bankruptcy Solutions

At The Tax Counsel™, our unique bankruptcy practice is intricately designed to navigate the complex interplay between bankruptcy law and tax controversy. Unlike many bankruptcy attorneys who may not engage with tax disputes, our firm is distinctively positioned to handle both. This dual expertise is essential as it allows for a holistic approach to financial recovery and tax resolution, ensuring our clients do not need to juggle multiple specialists during a financially stressful time.

Our practice is led by Marianne Dawson-Man, a seasoned attorney with profound expertise in tax litigation and tax dispute resolution. With her comprehensive background that includes an LL.M. in Tax Law and substantial experience in tax dispute resolution, Mrs. Dawson-Man understands the subtleties of how bankruptcy can serve as a strategic tool in managing and resolving IRS disputes and other tax-related issues.

We specialize in leveraging bankruptcy’s unique mechanisms, such as the automatic stay to halt collection actions, and the potential discharge of certain tax liabilities, integrating these with our robust tax controversy strategies. This integrated approach not only streamlines the process but also enhances the opportunities for favorable outcomes, allowing our clients to emerge from bankruptcy with a clearer path to financial stability.

Whether addressing straightforward bankruptcy concerns or complex scenarios involving significant IRS debts and disputes, our clients benefit from Mrs. Dawson-Man’s dual focus. This synergy allows The Tax Counsel™ to offer solutions that consider all angles of your financial picture, minimizing the need for multiple attorneys and simplifying the legal process.

At The Tax Counsel™, we are committed to providing our clients with comprehensive, informed, and compassionate legal services that address both their immediate financial challenges and their ongoing tax concerns.